Amount Due To Director In Balance Sheet

An asset money owed to the company or a liability money owed to the director.

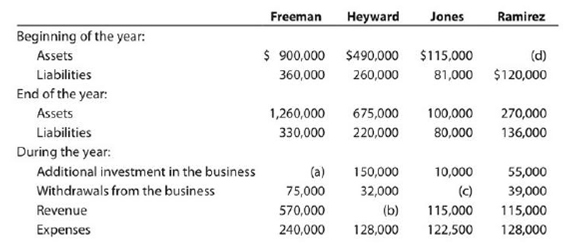

Amount due to director in balance sheet. A liability is created where the director lends money to the company to be repaid at a later date. Monies drawn down by the director. Surely the director s loan would have to be treated as a creditor and the other side of the entry should be an asset e g. The funds can be currently due or due at a point in.

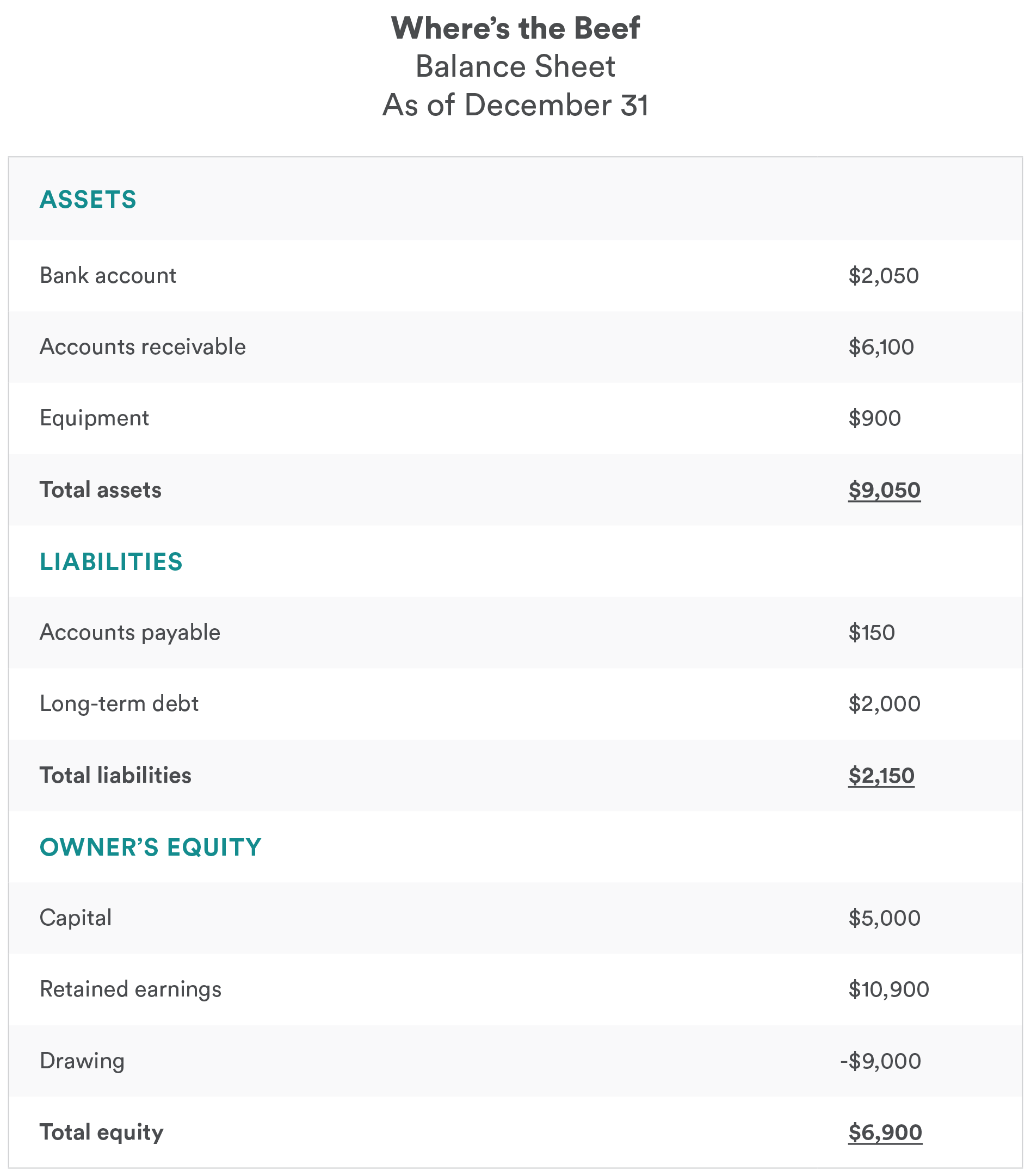

I have one issue about the dirctor loan. The due from shareholder receivable account may be paid within one year or it could carry a balance for a significantly longer amount of time. A due from account refers to an asset account in the general ledger that indicates the amount of deposits currently held at another company. Financial statements include the balance sheet.

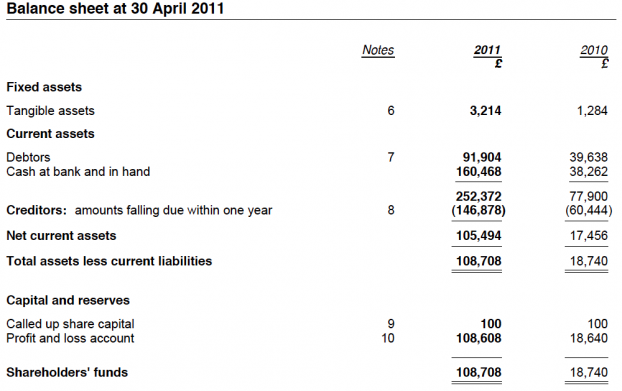

Net amounts due of salaries and dividends not yet paid to the director. It is simply an account in the balance sheet that summarises the transactions between a company director and the company. This seems madness to me. Share capital plus retained earnings or minus accumulated losses shareholders equity.

When the shareholder pays back the loan cash is increased and due from shareholder is decreased or set to zero depending on the amount of money paid back. Amounts due to the director from the company should be recorded in the company s books as a creditor while the amounts due from the director to the company should be recorded as a debtor. Dla s can be made up of. An asset is created where the company loans money to the director to be repaid at a later date.

I took a loan of 4k from my ltd company as director and paid back within 9 months so no tax implications. I am filing my company accounts ltd micor entity. The dla is a balance sheet account of course because the balance is either. However i do not know how to do the right reporting when filing for the corporate tax.

To my surprise the other accountant had recognised a 15k directors loan as a type of equity in this companies balance sheet. If there are multiple directors in the business each will have a separate director s loan account in the balance sheet. Personal bills paid by the company. My concern is the balance sheet.

Dla is an account on the company financial records that reports all transactions between the director and the company. Substance the leasing of a certain asset may on the surface appear to be a rental of the asset but in substance it may involve a binding agreement to purchase the asset and to finance it through monthly payments.