Gst Bad Debt Relief 2019

Among others it is a debt that is uncollectible.

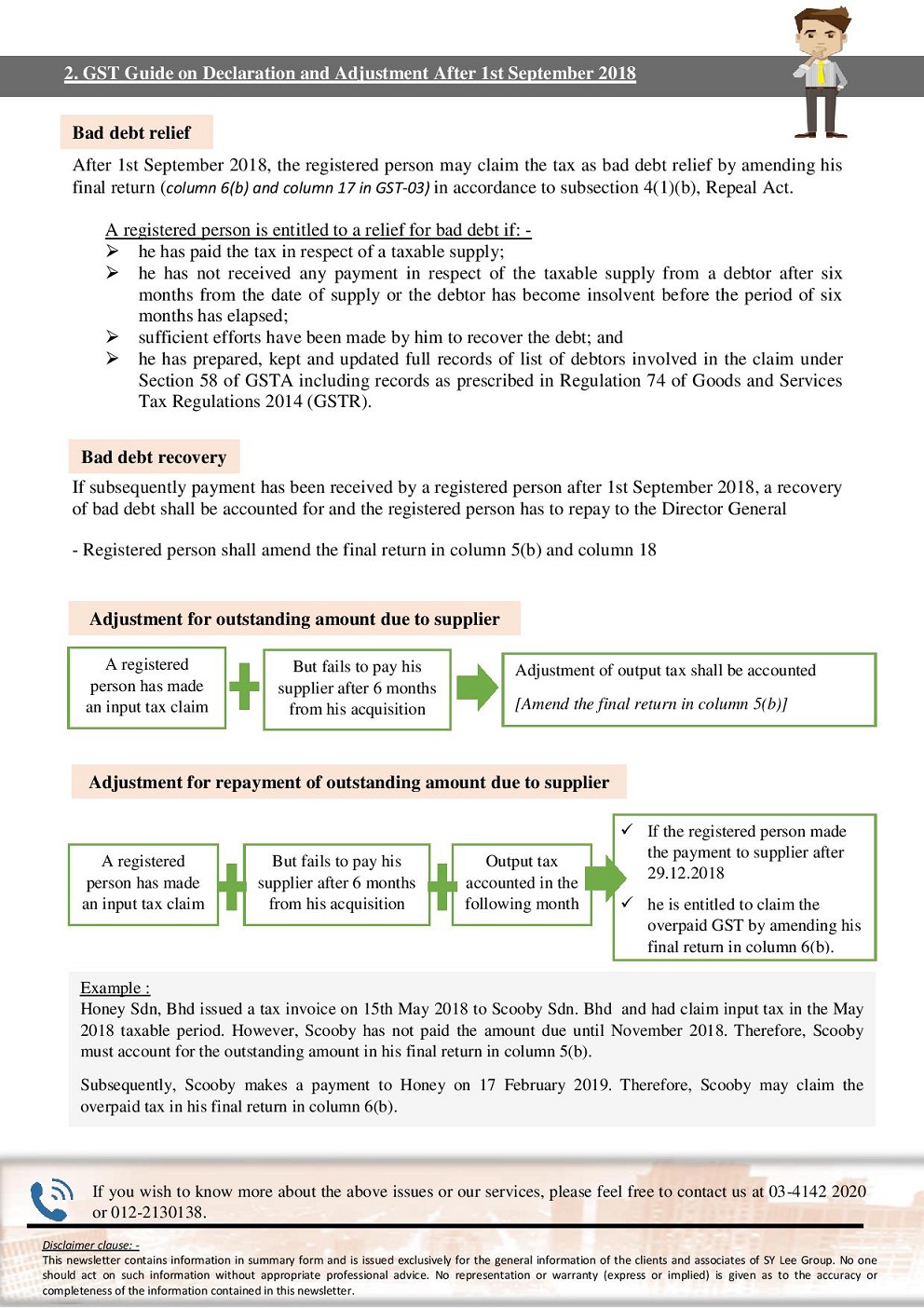

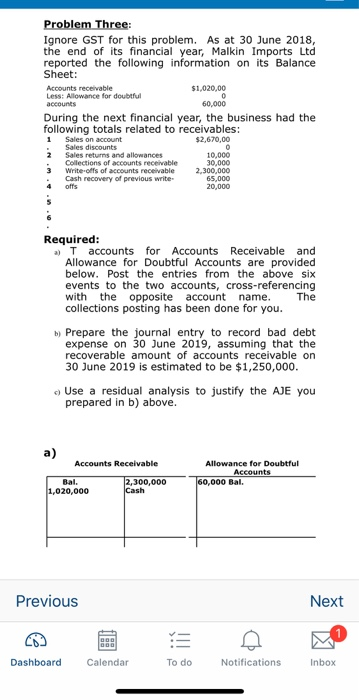

Gst bad debt relief 2019. You can apply for bad debt relief from the comptroller of gst for return of the output tax previously accounted for and paid by you. In the event where claim for bad debt relief has been made and subsequently payment. A bad debt situation occurs when money that is owed cannot be recovered. Hipster has to amend rm60 00 in column 6 b and rm1 060 in column 17 of the final return.

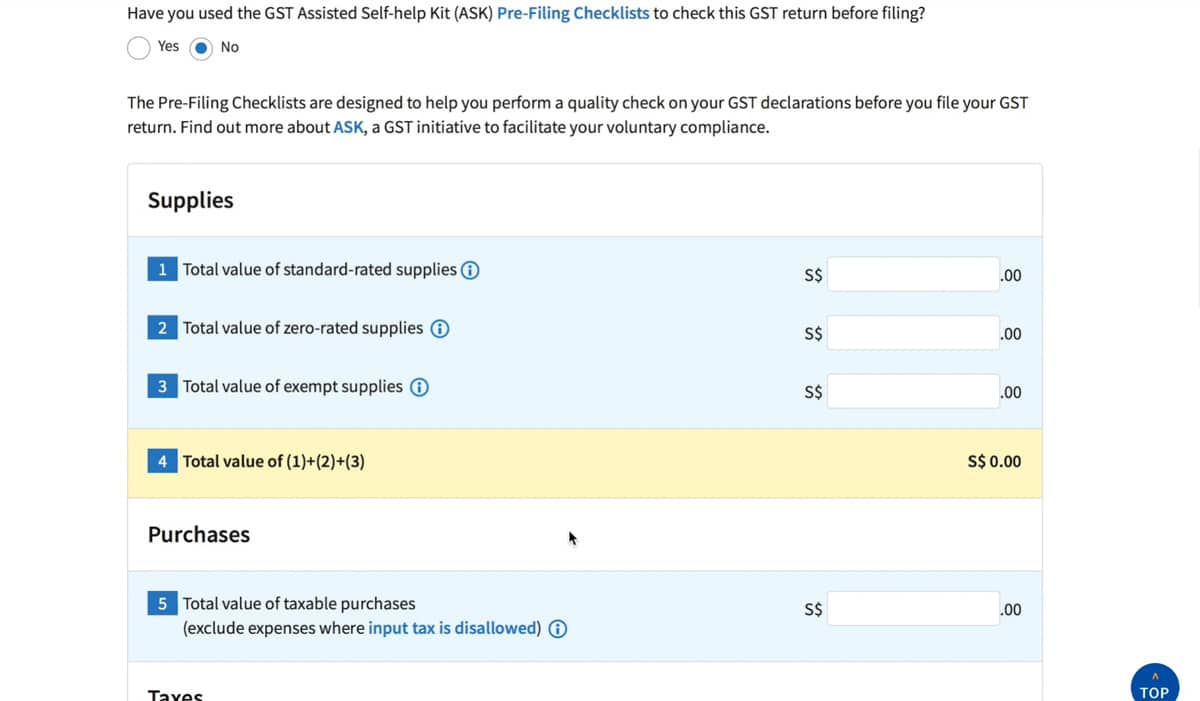

Therefore gst already paid on bad debts as used in the trade parlance cannot be adjusted. Declaration and adjustment after 1 september 2018 adjustment guide the adjustment guide sets out the process for bad debt relief claims after 1 september 2018 and for adjustment of input tax claims where payment has not been made for 6 months. In addition the sale must have been made at arm s length not a related party. Field in gst 03 value rm 6 a 6 b 60 17 1 060 18 adjustment for recovery of outstanding amount due from buyer 14.

The authors seek to dwell briefly on the legal provisions governing bad debts under the earlier law and the gst law. However hipster is only entitled to claim bad debt relief in the month of february 2019 after fulfilling all the required conditions. On the other hand if you as a customer have not paid your supplier within 12 months from the due date of payment you are required to repay to the comptroller the input tax that you have previously claimed if any. In common parlance bad debts refers to accounts receivable that will not be collected.

Bad debts the phrase bad debt has not been defined under the gst law. An adjustment to reduce a gst hst remittance is allowed by the cra only after the bad debt has been written off.